Update Actually a DOWN DATE Markets get creamed March 3 2025

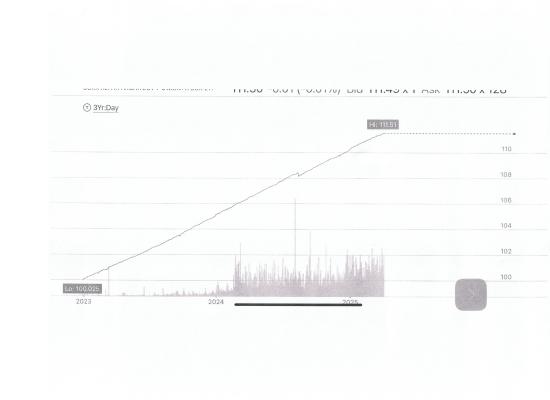

Check out this stock chart above !

As steady of an Eddie one could get.

Historically yields about a steady (as you can see) 5%

YES IT IS SOMETHING WE PUT IN PORTFOLIOS

Contact me if this kind of movement interests you !

Greetings!

March 3, 2025

Greetings!

The market fell extremely hard again today with the Dow down over 1600 points. Other indexes fell in similar fashion. That is the most since the CoVid fiasco.

Fortunately, with yours truly expecting and warning continually over many months that the market was overextended, we may not hold a lot of stocks per se. As a result, some portfolios may have been UP today.

I continue to prognosticate inflation will not be harnessed, and with amount of tariffs we are currently witnessing, inflation will only be exasperated.

Only time will tell if tariffs accomplish their intended result, which is to bring a significant amount of jobs back to the U.S. I am of the opinion that could have been accomplished instead with tax credits to American companies instead of taxing imports, which is what tariffs are essentially are.

If you hold multiple accounts, you may find some accounts were up, some were flat and some were down. Some of our holdings, being defensive in nature, may tend to move opposite of the markets. Such is the case today.

You might hold a good amount of Treasury debt like T-bill or similar floating rate funds that might not hardly move if at all.

Interestingly, some T bill funds may have made abnormally large price increases as investors fled to government securities for safety and drove these prices higher than many expected.

Good for us.

Additionally, T bill rates dropped uncharacteristically today by a significant amount so the new rates (yields or what we get paid) likely make the T bills we hold more valuable. It is the way interest rates interact with debt like T bills.

This means the T bills we may ALREADY own may now be inherently more valuable.

Other defensive stocks like Verizon, ATT and others we may hold rose nicely. It’s why investors like us buy them when we expect markets to fall.

Accounts which rose today make for happy investors. Accounts that fell may not have fallen much percentage wise comparatively.

Truth be told, in a market where tech stocks fell the most in 5 years, it would be hard NOT to see at least some erosion. Incredibly however, some accounts may have increased in value today.

Concluding, we will stay defensive. Although we do hold some stocks, we may remain heavy in fixed income holdings like bonds and T bills. We may see some brief rallies and some may be explosive. I find it humorous however, that the same business analysts that were telling us all was well and the consumer and the economy was strong, now are saying more downside may be in store.

While I still believe that is true, when I hear more and more analysts follow us into the warning mode, and then the wonks at the Federal Reserve follow suit, that will tell me it might be time to start nibbling.

“Watching the markets so you don’t have to”

PS: For investors who want guarantees of no losses, a triggered annuity or participation annuity will fit the bill. Downside is eliminated but upside participation is possible. See me for details. And call me if the above chart interests you!

Marc

(530) 559-1214