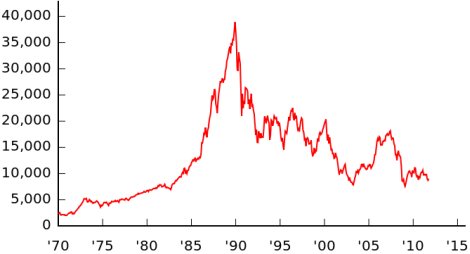

Watch out for possible market correction here Update Jan 17 2021

JAPANESE MARKET CHART

TYPICAL PATTERN

IS OUR MARKET SETTING UP FOR THIS?

READ ON

There is an old saying in the investing world: “buy the rumor, sell the news”.

This, like all other quips in the world of stocks, is by no means a precursor to what will happen, only what might happen. This saying refers to the possibility that a stock will rise in price as a rumor hits the mill, only to fall when the rumor becomes fact.

For example. Imagine a smart phone manufacture who is rumored to have a blowout quarter in an upcoming earning season. The stock might increase as the rumor makes its way around Wall Street and public media. Then when the company posts earnings, it is indeed a blowout quarter. Surprising many an investor however, the stock sells off on the news.

This would be a classic example of “buy the rumor, sell the news”. It doesn’t always happen where good news is sold off, but it has happened more often than one would think.

We can take this occurrence and extrapolate it to the general market. The question now becomes can the current market rally, which has brought it above 30,000 on the Dow for the first time ever, continue to set even higher highs?

It is no surprise the markets new high flies in the face of current economic conditions. Indeed, the economy, because of the CoVid shutdowns, has seldom been in worse shape. Meanwhile, since the third week of March, the markets have recorded historic gains, to rise from Dow low of 18,213 to over 30,000.

The markets obviously were not looking at what was.

What was, was an economy shuttered by CoVid.

Instead, it could be argued, the markets meteoric rise was because investors were likely looking at what will be.

What the market was looking forward to was a vaccine, humongous Fed spending, and an eventual reopening of the world’s economies. From week to week and from month to month, since the current environment was so bad, the hopes of a world reopening and what that would bring, was enough to push the markets ever higher. Its almost as if times were so bleak, the imagination of investors kept the registers ringing on Wall Street, and therefore, kept the stock market rising.

Fast forward to today, and we could be looking at an extremely overstretched market, which some argue is historically overbought on many levels. At this time, it might be time to ask, what more good news could come out?

The vaccine it here and the Fed has spent trillions. Reopening is happening and the vaccine is making its way around the globe. It is only a matter of time before the world resumes at least some sense of normalcy.

That said, as of now, I can only see one more piece of good news in our future and the rumor of that is already out. One more round of stimulus from the Biden administration is in the works, and we already know it is.

What this means, at least to this analyst, is that the good news, possibly all of it, is already baked into the proverbial cake. The market could be said to be as high as the good news warrants, and has nothing to look forward to.

In my opinion, with a market that has risen close 60% off its lows in a mere 9 months, it is time for caution. If portfolios reflect market gains, then profits could be substantial, and protecting such profits should now be the order of the day.

After all, it’s better to miss a market top, then ride a market back down in a severe correction.

A perfect “buy the rumor, sell the news” event may be setting up with the announcement of the final stimulus program from Washington.

That said, another saying comes to mind right now, and that saying goes something like this: “Nobody ever went broke taking a profit”.

Ignore at your own peril.

This article expresses the opinion of Marc Cuniberti only and does not reflect the opinion of any news media or financial firm and is not meant as investment advice. Investing involves risk and you can lose money. No one can predict market movements at any time. Consult a financial professional before making any investment decisions. A full list of service from Mr. Cuniberti can be viewed at www.moneymanagementradio.com. California Insurance Lic# 0L34249. Medicare agent and market analyst, Mr. Cuniberti graduated in 1979 with honors with a B.A. in Economics from SDSU. He can be reached at (530) 559-1214

MEDICARE

FIRE INSURANCE

MONEY MANAGEMENT

CALL ME