New shows coming! Read this update! December 15, 2017

Money Matters airs again on January 4th, 2018 so have a great holiday!

---------------------------------------------------------

Hi Money fans,

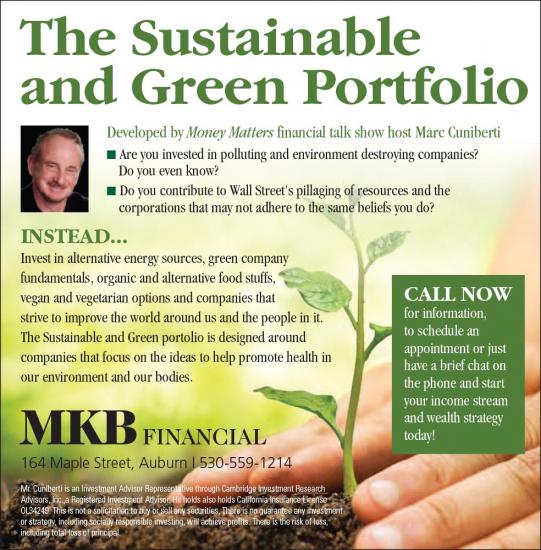

I spend so much time searching the markets and keeping up with what is going on my head spins. There is so much going on I don’t know where to begin. The markets are moving and we went more positive after October ended. The fall season is historically challenging so I was careful and in hindsight, although I would do it again, the markets yielded little challenges. That being said, as we go into the new year I would expect more of the same unless an unknown event transpires in the markets. Read below some important news articles and updates. As to other things, the business is great and new potential clients and fans are coming forward almost weekly. I also have TWO NEW PORTFOLIOS for you to take a look at. The first one is a SUSTAINABLE AND GREEN FUND where we look to the environment and human health as where to invest. Guilt free investing and encouraging Wall Street to sit up and take notice of us that care about what it going on in our world and our fellow women and men. Check the ad out below.

Next is our Income Stream Portfolio. This is for folks that need income. Like a rental unit one might have, this portfolio holds about 25 stocks scheduled to pay dividends every so often like quarterly or whenever. Hold 25 and one might receive 100 checks a year! Think of it like owning a rental house where you just hold and get checks. Pretty neat. I choose only companies have been around years and have great dividend histories of keeping or increasing them. Check this one out here:

Our traditional portfolios also provide margins of safety in a variety of strategies. Why not give me a call to discuss your needs and review your holdings. Let me tell you why we are different in many ways and why the media world goes to Money Matters for their money matters! My personal cell is (530) 559-1214.

------------------------------------------

Now read about the rallies in markets and about how dividend paying stocks function below:

Fed Chief Janet Yellen will finish her term soon. Will it matter?

213254 approved

With the Dow Jones Industrial Average (DJIA) racing to new highs almost daily, one has to ask, what is driving this market?

Certainly there are enough Donald Trump haters to cast a dim light on anything financial, where even many are doubting the civilized world itself will survive if Trump continues as President. But one cannot deny that the DJIA has loved this President, as evident by the rally that has been in place since he was elected.

With the DJIA making news headlines with every milestone it passes, the news might entice some investors to review their statements and then call their advisors to see why they haven’t doubled their money in light of this almost relentless rally.

Although the DJIA is the most talked about index in the media, it encompasses only 30 stocks of the thousands that are out there in the various marketplaces.

The question some may ask: is the Dow a realistic representation of the market in general and the economy.

On the latter, I have always said the market will reflect reality eventually but its day to day movements are only the sum of the perceptions of all the players in it at any given time. For example, late in the housing boom cycle after Bear Sterns collapsed two funds tied to mortgage products (the proverbial first domino to fall in the real estate blow up), the reality was the housing crisis was already in its early stages of implosion. That was the reality. The perception however was that real estate never falls in value and any set back would be temporary. Housing stocks therefore continued to climb as the housing market was beginning its historic collapse. The perception that all was ok drove these stocks ever higher even though in reality the real estate market had already turned. The market did however eventually reflect that reality when all the indexes worldwide eventually cratered miserably.

That being said, the perception at least up until now, is the economy is strong and the stock market is justified in roaring upwards.

Certain things however might not add up and be confirming of the apparent strength of in the market meaning not all assets are firing on all cylinders.

If the economy is galloping forward in strength, one might expect the commodities and energy sectors to be in high demand and therefore screaming upwards as well.

Such in not the case, at least in the proportions the Dow has climbed. Indeed some energy and commodities have languished badly and or gone nowhere. (Yahoo.com). Since booming economies need energy and commodities, why have we not seen these asset classes go up in concert?

Additionally the Dow index is very limited in what is has in it. Remember it only has 30 stocks out of thousands and only seven stocks make up almost half of the index weighting (42%- Forbes.com) Some have even speculated the people who decide on what stocks go in the Dow rotate the losers out and replace them with winners in order to make it look better. This idea was put forth by QZ.com in an article by J.L Zargosky

Matthew Yglesias of Slate.com goes so far as to call the DJIA a “nonsensical index” due to how it is purposely constructed to favor more positive results.

Indeed just the fact that the DJIA contains only 30 stocks might be enough to convince the investing public to better observe how the market in general is performing by looking at a variety of indicators and markets. Indeed many of those indicators are positive.

But because most investors hold a variety of assets in their portfolio which include assets that might move in opposite of a rising market, and because there are stocks in many areas that have actually gone nowhere or even fallen in the midst of this rally, its likely few portfolios have seen proportional increases their value that the DJIA has. Additionally because fixed income investments (bonds and preferred stocks to name a few) may have moved opposite of the rally, some portfolios may actually have lost value.

Keep in mind this is not a solicitation to buy or sell any securities. It is not possible to invest directly in an index. Past historical movements in any security does not guarantee future performance.

-------------------------------------

Approved 215473

Since the 2009 crisis, few would argue the stock market’s general trajectory has been up. More than tripling since the crisis, the most watched index, the Dow (DJIA) is approaching a quadruple.

Witnessing this historic rise, an observer would likely conclude the economy is firing on all cylinders and business is brisk. But if this is the case, the building blocks of business, commodities, should also be rising. Instead something seems amiss in the general price of commodities or perhaps in the metrics that measure them.

Commodities are a commonly traded asset class and when it comes to the simplicity of composition, few things are easier to understand then commodities. They include food stuffs like soybeans, corn, wheat, milk and sugar among others. Energy fuels like natural gas, oil and propane are consider commodities and well a variety of metals as well as agricultural items. Basically it’s the stuff that we make stuff out of. One could also conceptualize commodities as the tangible items used in manufacturing.

Since the economies of the world are made of up both service and manufacturing companies both use tangible items in the implementation of whatever they do, if the economies of the world are indeed booming as a rising market would imply, why have commodities basically gone nowhere since the crisis ended almost 8 years ago.

In a Feb 20th, 2017 article by Forbes entitled “Commodities have been down for so long….” author Daniel Fisher, the stark reality of commodities is summed up nicely: “The U.S. Commodity Index Fund, not surprisingly, has a five-year record of negative 8.4% a year”

Read that again.

With the Dow standing at 7062.00 February 1st, 2009, and recently breaching the 24,000 mark and more, the price comparison between the Dow since 2008 and commodities is indeed baffling.

With more than a tripling of the Dow, one might ask: where have all the commodities gone?

One might conclude apparently not into the companies that make up the stock market.

The possible explanations could be many but are they convincing?

Is there a glut of commodities and if so, is even possible for every commodity to be in an oversupply condition. Could speculators be keeping the prices down and if so, could they suppress prices for so long over such a wide market? Could falling currency values reflect lower prices because of price is only a function of the currency it’s priced in? Accepting that would mean accepting a worldwide appreciation of all currencies relative to each other, a nearly impossible scenario that indeed has not been the case.

The fact that the stock markets of the world have been headed in a concerted upwardly direction since 2009 is baffling enough, but for commodities to be going in the opposite direction almost the entire time is even more mysterious.

What may be the root of this mystery might be some unpalatable explanations of a stock rally that is fueled by something else besides basic demand. Either that or the rally is fueled by demand but not the kind of demand that consumes commodities but by the demand of stock ownership. In other words, stocks are rising because investors simply want to own stocks. Additional demand could be also coming from the companies themselves buying back their own shares. Another explanation could be the easy money and low interest rate policies of the last eight years by central bankers which is flooding the world with paper dollars and those dollars are chasing stocks.

Whatever the causes for this unrelenting rise in markets, one thing stands out: the commodity markets could be telling us there is more to this eight year rally than meets the eye.

--------------------------------------------

Approved 205063

Dividends are payments by companies to shareholders. They are at the discretion of the company and can be changed usually at any time in a variety of ways including to increase, reduce or eliminate them.

Companies may utilize dividends to entice people to buy their shares and hold on to those shares for the payments. Some companies pay dividends and others do not. Some companies never paid them, some used to and some may even start to pay them in the future. The point being made here is companies can do whatever the heck they want as long as they don’t break the law. And fooling around with dividends is usually a common occurrence.

An obvious observation to make is in order to pay out money, the company first has to have it. And therein lies the caution. Like any other entity needing cash for whatever reason, a company short on cash could still pay out a dividend or a series of dividends by borrowing the money to do so. But having to borrow money only to turn around and pay it out might not seem like a prudent financial decision and in many case it isn’t.

When an investor buys a stock for its dividend and that dividend is increased, it makes for a happy investor. Usually it also makes for more investors buying the stock. When a dividend is cut, the reverse might be true and the stock may fall as investors head for the exits once the payments go away.

How can you tell if a company can afford its dividend or is living on borrowed time (literally) in order not to spook investors by reducing or cutting its dividend?

There are a variety of indications but unless you are on the Board of Directors making that decision, an investor can only make an educated guess based on the public information about the company’s financials.

Without getting too complicated, your question is: does the company have the cash to pay out its dividend and for how long? If not, when will it cut or eliminate its dividend in the future?

A lot of it boils down to what is called “free cash flow”. One obvious question is if a company pays out five million in dividends, does it have the cash after paying its bills to pay the investor?

Another question would be even if the company is making enough in profit to pay, is the company banking that profit when dividend time comes around.

It can all boil down to it free cash flow. Is there enough cash left over after all expenses to pay out the dividends promised and is the cash received in time to pay the dividend when it’s due. The other issues are can the company continue to make enough money to continue to pay its current dividend over the long haul or will it eventually have to cut or eliminate it because profits and the receipt of such profits eventually fail to meet the obligation?

The ability to pay dividends hinges on many events but the first question investors can ask is the basic one: can it afford to? A good place to look for that answer starts with its cash flow. An old saying in business is “cash flow kills”, and when it comes to dividends, those words couldn’t be truer.

**********************************

All the best, we will watch the markets so you don't have to...

Marc

Articles express the opinions of Marc Cuniberti and are opinions only and should not be construed or acted upon as individual investment advice. Mr. Cuniberti is an Investment Advisor Representative through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Marc can be contacted at MKB Financial Services 164 Maple St #1, Auburn, CA 95603 (530) 823-2792. MKB Financial Services and Cambridge are not affiliated. His website is www.moneymanagementradio.com. California Insurance License # OL34249