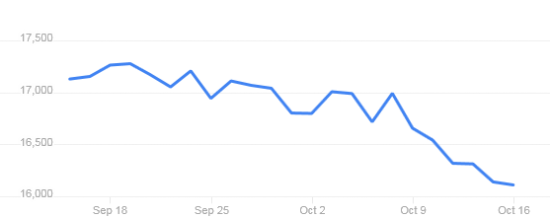

Market Hammers! WHY HOW WHEN WILL IT STOP! ANSWERS HERE ! MONEY MATTERS AIRS TODAY UPDATE OCT, 2014

THE DOW JONES INDUSTRIAL AVERAGE

MONEY MATTERS AIRS TODAY AT NOON PST

Marc’s Note

"Fall can be the time for market falls" (Money Matters newsletter last month)

Our call that the market bloodletting would stop last week or so was a bit off but I think only the exact timing was. The continuing erosion in the indexes however causes us little concern. The general market has not had a 10 % correction in about 3 years or more, and one is long overdue. We always warn about this time of year to be cautious.

Since our general position in the overall strategy of holdings is only a 20 or 25% allocation in stocks in the first place, the recent rout should cause you little discomfort. Seeing as most investors follow their advisors into the stock abyss however, a heavier dose of stocks in your portfolio means the pain is likely stinging your senses a bit. The general feeling I get when evaluating this sell off is that is likely coming to an end if not slowing a bit. We have to obviously stop falling to start rising again and this slowing of the descent has to first take place before the halt before the eventual rise again.

Without the Feds idiotic foray into the markets, both bond and stocks, I do believe the markets would have hit the few thousand mark in 08 and 09, and the world, although not coming to an end, the resulting social mayhem would have been very uncomfortable for all.

Seeing however that the Fed took the high road to easy profits (for the banking sectors in general) their new reality is to believe they can control the economy thru a series of pullies and levers which are their monetary policies.

Never mind the fact it’s never been done despite thousands of attempts by very smart people (or not so smart) throughout history. The current population of academics in our centuries think tank called the Federal Reserve and their siblings the IMF and the central banks of the world believe the thoughts and minds of the billion or so investors that make up our worlds markets can be viewed as if by magic by thru the crystal balls of their statistical minions who are goaded on to forecast only the most rosiest of projections. That a worldwide ball of compiled investors thoughts and minds cannot possibly be controlled by any group is made even more comical by the fact the statistic(s) they use to attempt such folly is folly itself.

That being said, try they will using massive amounts (copious actually- eyepopping) of conjured money in all types of currencies which are just different colored and of varied design worldwide to try and push, pull, feed and starve whatever ails or sickens the natural markets and economies.

Seen as a disease rather than a cure, (which a cure it actually is- one of them anyway), the recent market selloff will prompt another erroneous dose of the same pleasantly flavored elixir that was administered so many times before: more printed, pretty colored paper in digital hyperspace, to be whisked at lighting speed thru optic cables everywhere into the brains of the banking sectors where the minions there will disperse it into the public’s bloodstream via the stock and bond markets of the world.

As long as this flawed model exists in the eyes of the monetary masters, any routs such as the one we have today, if amplified by market forces, will be dealt with swiftly and repeatedly until it succumbs to the steroidal effects that printed money always has: to send asset prices soaring.

Until such a time where the patient collapses from too much monetary heroin, he will again stumble to his feet to march on until the next fall, where the process will be repeated until he can get up no more.

We are not there yet. This market fall will end soon.

Buys to look at: the Netflix recent hammering, energy and the first five stocks on my BRAND NEW SUPER DIVIDEND PAYERS LIST just out. Pick it up today for the price of half a dinner out!

---------------------------------------------------------------------------------------------

Notes:

The Everbank CD is closed. I will advise if they reopen it or extend its term.

No cost solar is here for YOU! Click on the Solar City Link on the right of the webpage moneymanagementradio.com

Hop on my new SUPER DIVIDEND PAYERS LIST today for even greater buys at paying stocks at even LOWER prices which means HIGHER PAYOUTS to YOU!

See link here:

http://moneymanagementradio.com/cart/super_dividend

---------------------------------------------------------------------------------------------------

The stock sell off in recent weeks has been brutal, although nothing like the 2008/09 market crash that wiped out half the indexes.

Market routs can test both investor patience and their investing strategies and its one of these strategies I want to bring to light today.

I have always said money managers, financial advisors, consultants and their firms usually perform no better than the overall market and sometimes much worse. Add in all the fees and commissions they charge and the losses can mount even further.

One look at your investment statement this week will probably confirm that claim. Without even seeing your statement I can magically tell you that your losses probably amount to between 6 and 12% of your total portfolio value. More aggressive strategies may have lost even more.

In many previous articles and shows I have done, I have made the argument that an investor could manage his own portfolio and probablay not only have better performing assets but reap the added savings by avoiding all those fees and commissions that investment services and individuals charge their clients.

Want proof? Just look at any one of the major indexes performance since the 2009 crisis.

The Russell 2000 tracker (IWN) has almost doubled since 2010, the Nasdaq (QQQ) has more than doubled, and the same goes for the S&P 500 (SPY).

Now look at your managed account statement. Did you double your money in that same amount of time?

Probably not.

Not only did all your stocks and funds not match these simplex indexes, once you add in all those fees, commissions and sales loads, the underperformance is significantly amplified.

This is not just my opinion.

In his popular personal finance book arguing that investors can’t consistently beat the market (A Random Walk Down Wall Street), economist Burton Malkiel says that “a blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts”. (Never mind the fees).

So in 1998, the Wall Street Journal decided to see if Malkiel’s theory would hold up and created the Dartboard Contest. Wall Street Journal staffers, acting as the monkeys, threw darts at a stock table, while investment experts picked their own stocks. After six months, they compared the results of the two methods.

On October 7, 1998 the Journal presented the results of the 100th dartboard contest. Although the pros won 61 of the 100 contests versus the darts, the performance of the pros versus the Dow Jones Industrial Average was less impressive. The pros barely edged the DJIA by a margin of 51 to 49 contests. In other words, simply investing passively in the Dow, an investor would have beaten the picks of the pros in roughly half the contests (that is, without even considering transactions costs, fees or commissions).

Although the financial community and probably your advisor will roll thier eyes if you show them this article, you can counter the gesture by tossing any one of the market indexes on his or her desk and ask them, if, including all the fees, loads and commissions, he bested any one of the general market indexes.

Then ask how your portfolios been doing in this latest sell off. My guess is your holdings have once again followed the market down and most likely fallen more than the general indexes themselves. Not a pleasant reality to be sure.

What all this means is that an investor (know any?) could open up a discount brokerage account at one of the many institutions available (like Scott Trade, TD Ameritrade or Schwab), manage their own money by just buying a handful of the major index funds, have a better performing and more diversified portfolio, save on all those fees and commissions and in the process make more money on their investments.

This article expresses the opinions of Marc Cuniberti. Mr. Cuniberti hosts “Money Matters” on KVMR FM 89.5 and 105.1 FM on Thursdays at noon and syndicated on over 30 radio stations throughout the US. He has been featured on NBC and ABC television and on a host of made for TV documentaries for his economic insights. His website is www.moneymanagementradio.com