Money Matters Update- Apple stock and the Sequester Cuts. March 2, 2013

BIG BEN- SWEARING TO FUNNEL AS MUCH MONEY TO THE BANKING MASTERS AS WE ALLOW HIM TO.

Marc’s Notes:

So the “Sequester” (why DO they put these funny names on these things) are just the cuts everyone agreed to and yes Obama signed them too. It was the “deal” that BOTH sides of Congress and the President agreed to if they allowed the debt ceiling to be raised.

The law states the US can only spend up to a LIMIT. That limit is set in stone. After you borrow so much and owe so much, you reach the LIMIT and you cannot spend anymore until Congress raises it.

So we reached the limit about 18 months back (like an overspending spouse) and to get Democrats AND Republicans to agree to allow an increase, everyone agreed to form a “Super Committee” which would then hammer out cuts that the Congress couldn’t.

The additional condition was if the committee couldn’t reach an agreement, because it couldn’t the first time thousand times, then automatic cuts (now called the sequester) would take place. An incentive and sort of a doomsday like event which would give them good cause to agree (which apparently wasn’t good enough) and a consequence if they failed to agree. Both Democrats and Republicans signed it as did Obama.

We all know what happened. Nobody agreed on any cuts (again) yet Obama got his increase in the debt limit. The committee couldn’t agree so the automatic cuts were scheduled for January 1, 2013. That was called the Fiscal Cliff because it coincided with some tax cuts that just happened to be set to expire on the same day (Bush tax cuts).

Washington’s fear mongers hit the streets and scared everyone that Jan 1 was a date in infamy and we needed to kick the can down a bit. They did and the cuts were cancelled until March 1st. Now here we sit with the fear mongers running around again, Obama being the leader of course, wanting to renege on his promise and signature as well as everyone else who wants to do away with, reschedule or alter the promise they made to us 18 months ago. Now comically, we are at another debt ceiling and need to raise it again when we haven’t even stuck to the promises we made the last time around.

No where in the press that I can find is mentioning the fact these cuts were a condition of the last debt increase and that everyone screaming signed the damn cuts and agreed to 18 months back. Now all we hear is how bad the cuts are going to hurt the economy and how we can’t stomach it because seniors and the sick, the poor and destitute, the teachers and cops and everyone else who don’t occupy the ivory halls of Washington will suffer.

The parks will close down and the schools will close but President Obama will still go on his golfing excursions. Never mind cutting the massive government departments like the useless Department of Energy who has done nothing to lessen our dependence on foreign oil (its original mission) yet eats tens of billions a year, or cutting the Department of Homeland Security who have caught no one since their inception except handcuffed some shoe bomber who couldn’t get his bomb lit, or nabbed some kooks car in NY not because of the departments hundreds of billions but because some average joe noticed something weird. Never mind cutting the bailouts which total hundreds of billions to mega banks, or getting back the 50 billion they gave to General Motors, the hundreds of billions to AIG or the trillions given out to the offshore foreign banks. Don’t bother getting back the tens of billions in tax money the homebuilders got back when the housing market they fueled cratered and subsequently got all their taxes back on all the profit they made. Don’t you wish you could get your taxes back? They did and kept the profits to boot.

No, Washington instead closes Yosemite, makes us wait in longer lines at the airports or puts 911 on hold so you’ll bitch about the so called cuts and give them the green light to do away with them and bankrupt instead our once great nation. Lets starve the elderly instead of having Wells Fargo and Bank of America give back the quarter of trillion they got for all those bad mortgages they made billions on (and WE still own as taxpayers) while they get off scot free and pay even bigger bonuses.

Let’s fire some firemen so when the urbanites set fire to the city because they are starving because the Federal Reserve drives up food prices so high with bailout money and then the firemen wont come so your house burns down.

Lets turn off some power to the old folks and starve them out instead of getting back a cool 300 billion from Citibank and Goldman Sachs which got all that money for more toxic crap they created and made billions on.

Let’s give some idiot $8000 dollars to buy a house off a bank balance sheet so he takes the loss instead of the bank, or give some broke dude a $5000 clunker credit and a car loan so the automotive unions will get paid so the auto companies and union cartels will give back money to keep those same politicians elected. Then make sure we all are made aware of the sequester cuts by turning away my sick grandmother instead of getting our tax monies back.

THAT’S what the sequester is all about. It’s not about a few billion in spending cuts plummeting our economy in a recession. Its about finally facing the music and acknowledging our government has a spending problem, and not a revenue problem like they would have you believe because no matter how much they get or how much we give them its never enough. They will always spend more. Don’t fall for that “greedy corporations making obscene profits” BS. Exxon makes no more off a gallon of gasoline then Disneyland makes off an admission ticket or McDonalds makes off a hamburger.

If Obama was so concerned about high gas prices, why not remove the more than 20 % Federal Excise and state tax they put on each gallon of gas we buy. That right there would drop the price of gas to 3 bucks right there. Don’t kid yourself. Washington is fully aware of the money they make on gasoline tax yet they don’t volunteer that.

Instead they give Ben Bernanke the permission to print up 85 billion a month and give it to the banking cartels.

As if we haven’t given them enough already.

It’s a sham and a con and why we Americans stand for it is beyond comprehension.

They subsidize big oil, they subsidize big corpa, they subsidize big auto, big farmers, foreign countries and foreign banks then tell us we can’t cut a few billion in spending because our economy can’t function without it.

Why not get the 100 billion in sequester cuts from stopping these subsidies, bailouts, handouts, taxes and tariffs?

They pocket it all then say they will close the parks, make us wait in horrendous airport lines and watch our houses burn and poor starve because we can’t afford it.

America, wake up.

Money Matters airs this Thursday, noon Pacific Standard Time on KVMR FM and world wide on the web at www.kvmr.org.

Money classes are registering now, email us for a spot.

All for now, now enjoy my latest article on APPLE.

Marc

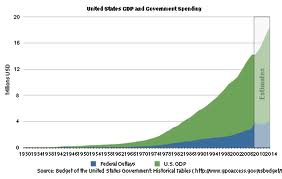

Federal Spending Chart- Aint that a bitch.

Apple- bad fruit or just ripening?

What’s going on with apple stock?

From a high of over 700 bucks a share, it has dropped by almost 40 % in a few short months.

Seems like the Wall Street darling has become the proverbial red-haired step child.

I did a news piece a few days after Apple CEO Steve Jobs passed away, saying that

Jobs was Apple’s center of creativity and with his passing it may spell trouble down the road for Apple.

I detailed in the piece that Apple wasn’t the only company with smart people in research and development and that one day the mighty Apple might become just another tech stock vying for a part of a much desired pie. I suggested that the once great computer company had perhaps become just a fancy device making company.

Although I did not expect Apple to fall from grace so suddenly, the news piece came true in spades and what happened to Apple can happen to any market leader.

Many times companies are the prodigy of their founders and one could argue that Steve Jobs was the reason Apple was so successful. His creativity and ability to see miles ahead of his competitors as to what consumers would want kept Apple at the forefront of high tech gadgetry, if not actually leading it.

But cutting edge companies have to stay cutting edge, and if you come out with a great product, or many great products like Apple had, it won’t be long until other companies step up and offer similar products which will start to cut into market share.

Without constant innovation and that cutting edge technology that got you there, companies will start the fall down that slippery slope of losing market share to copy cats and other innovators. These companies may even improve on where you left off.

At 700 bucks a share, Apple was priced as a cutting edge company. Although not expensive on an earnings basis, the market perception of Apple was that it was a cutting edge company. Now that it appears vulnerable and with no Steve Jobs to rescue it, investors are selling it off and a brutal sell off it is.

Apple still has great products and another fantastic one could vault Apple into the stratosphere again. The problem is no one can really be sure when that new product will emerge if it emerges at all.

From an investor’s standpoint, Apple is still fairly cheap earnings wise; the company has oodles of cash and now sports a 2 % plus dividend to boot. It has super loyal customers and the branding of a lifetime behind it. With all that going for it, although more downside may be in store for Apple, once this stock bottoms, this is one stock that may be no bad apple, even if you have to hold onto to it for a while.

This article expresses the opinions of Marc Cuniberti. Mr. Cuniberti hosts “Money Matters” on KVMR FM 89.5 and 105.1 FM on Thursdays at noon. He has been featured on NBC and ABC television and on a host of made for TV documentaries for his economic insights. His website is www.moneymanagementradio.com