Lifetime Income versus growth Does it really pay to have lifetime income over growth YES.. udpate July 24 ,2023

Hello and welcome to Money Matters

We do not spam or sell addresses... FYI

We feature Marc's newscasts weekly or so and shows- no charge

Keep up on market news in a way that is easily understandable.

----------------------------------------

Hello!

Marc here from Money Matters. I recently gave a seminar covering a way to earn 10, 12, 14% a year for life- guaranteed or more!

It is simple to understand and from one of the country’s best companies.

“Nationwide is on your side” is their motto.

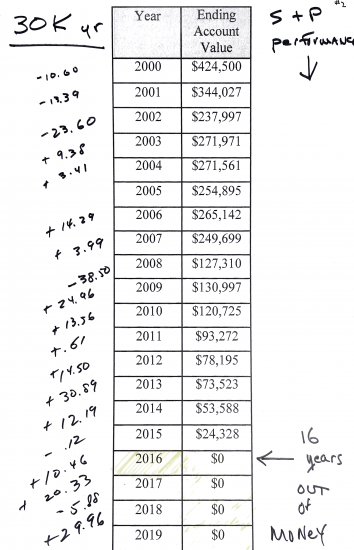

Had you had $500k in the stock market from 2000 to 2015 retired and withdrew $30,000.00 a year, you would be out of money by 2015!

LOOK:

So much for using the market for retirement.

With the Bonus Income for life, you could earn double digits or more (depending on your age) and never run out as those returns are paid for life!

You heard that right. Double digit returns for life.

A 59 year old waiting until age 70 would get 13.41% APR for life on what was put in starting at age 70.

A 73 year old would get a minimum of 15.22% APR starting at age 80. If he or she wanted immediate income for life as soon as they deposited their money they would get 8.31% starting at age 74!

Whatever is not paid out is returned if you pass. Even better, the proceeds are guaranteed and 100% principal protected. Nationwide also guarantees if the market goes up by a predetermined amount you could get even more. But never get less than what is guaranteed. So participate in up markets but never lose a dime in down ones.

No medical exam or questions. Easy to open. I can run you YOUR income for life figure easily by knowing your age only. See what you would get. Today’s interest rates historically won’t last as the FEDS themselves predict rates will come down so lock your in before they do.

No fees to set it up and Nationwide puts in 20% more of what you put in as soon as we open the program! Put in 100K, Nationwide adds 20% to the income base immediately.

Let me run your income for life figure today.

Call me (530) 559-1214

Voted Best financial advisor 2021 and with California Insurance License #OL34249.

Financial columnist for 5 newspapers with radio show MONEY MATTERS on 67 radio stations nationwide.

Disclaimer: This is not a recommendation to buy or sell any securities. May include forward looking statements. Past performance is not a guarantee of future results. No one can predict market movements at any time. Investing involves risk. You can lose money, including total loss of principal. Consult your tax advisor for all income tax related questions. Stop-loss strategies utilize stop orders which turn into market orders, so they may not limit losses. Dividends are not guaranteed and may be cut or eliminated at any time and may not prevent losses. Annuities are not FDIC insured and are insured and guaranteed by the underlying insurance company only. Early withdrawal penalties may apply. Management fees are not allowed once funds are moved to an annuity. Annuities may or may not be suitable for all investors. Indexed funds attempt to track the underlying index but are only a proxy for that index and may or may not track the index exactly.

Special note: For those wishing principal guarantees and possible market upside participation, you may consider a fixed indexed annuity. Purchased annuities have no management fees and are 100% principal protected. These I have found are desired by those that cannot tolerate any losses whatsoever, or are extremely sensitive to any kind of loss. They also will participate (rise in value) if the market (S&P 500) rises between the applicable time periods as set forth in the contract, so they have a minimum guaranteed interest of 7.2% over the life of contract OR you get a portion of the increase in the market. The greater amount of the two is what they guarantee and always 100% guaranteed to get at LEAST all your principal back and a MINIMUM of 7.2% on the entire balance OR the market upside, whichever is GREATER. The best of both worlds. Contact me for details.

NOTE: Money Matters classic piece (Classic pieces are one step above and recognized as breaking news casts with the hottest of topics illustrated in a way that makes them in high demand and talked about. The highest response metrics are observed by a minimum of 200% for all "classic" pieces).