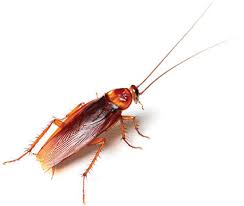

Another cockroach.....

A few weeks back I penned a Money Matters article quoting famous investor Warren Buffett, that when it comes to a banking crisis, he said “there is never just one cockroach”

Buffett nailed it years ago when he coined this ever so accurate assessment of how banking problems progress along no matter where or when they have occurred.

Buffet, in his annual shareholder meeting last week, addressed the current crisis, blaming the problem on everyone from bank managers, auditors, regulators, the Federal Reserve and even the U.S. government. Buffett stated that bank oversight is “messed up” and many people “want it messed up”.

Not much word mincing there eh?

Despite repeated regulations along with assurances over decades by all the above, we find ourselves once again being told banks are failing, that there is nothing to worry about, and that the event is over.

The only truth in that last statement is that banks are indeed failing. The rest is frankly a big pack of lies. And yes, lies is the correct word, because if they’re actually telling the truth, they are incredibly ignorant. And if that ignorant, incredibly dangerous.

Biden recently came out (again) and told us that the banking `system` is safe and that taxpayer money will not be used for bailouts.

It is said when the government denies something, it’s a sure sign it’s true.

I can say, from my point of view, your money is “kinda” safe, that the banking `system` is far from “safe”, and that taxpayer money will absolutely have to be used as the FDIC doesn’t have THAT much money.

Of course, when the FDIC runs out of money they just get more from the FEDERAL RESERVE, and the way the mechanics work, round about your taxes will pay for a lot of it.

Dissecting the most recent banking crisis in my last article (email me for a copy) I will only add the word “ditto”, and that you should read the last article.

The latest cockroach to scurry into view is First Republic Bank with branches throughout the San Francisco bay area. With assets worth an estimated 220 billion, the total bank failures that have occurred in the last few months now exceed the total size of bank failures by assets than the infamous 2008-09 banking implosion that almost brought down the global financial network.

You remember that one don’t you?

After four decades of studying economics, I am of the opinion the Federal Reserve, and other central banks like it, attempt the impossible while believing otherwise.

Originally established as the lender of last resort, we can better describe them as the printer of last resort. Money printer to be exact. Nowadays, and for many a past nowadays, they believe, as the does the governments that establish such entities, that an economy can be controlled like some sort of automobile. Step on the gas and away we go, apply the brakes and slow it down, turn right and we go off in one direction and turn the other way, and we go off in another.

Obviously, we have learned from decades of market crashes, recessions, depressions, and bank failures that the Feds obviously can’t drive very well. But even though its hit many a wall, it assures us it has the driving skills it needs to eventually get us to our destination.

The reasons are many why a central bank can’t do what it thinks it can, but without venturing out to far, I liken their efforts to weeding with hand grenades.

Yea, it’s sort of like that and the visual pretty much describes it. Basically its tools are incredibly massive and massive only. By its sheer size, the Federal Reserve cannot tread lightly, pulling troublesome financial weeds where they sprout. Instead it tosses their financial weapons to and fro, blowing up chunks of the economy while trying to remove a specific problem.

And what does it get for its efforts?

Much like weeding with grenades, its blows big holes in various spots around our economic garden, causing even more destruction.

Look no farther than the current (and reoccurring) bank crisis. Raising interest rates to quell inflation, it destroys bank profits by hammering the mechanics of where banks place your deposits. (Again read my last article).

In conclusion, one doesn’t have to understand how we get from there to here when it comes to the Federal Reserve. We just have to see the destructive holes it’s left, and right now they are currently all over the banking system.

“Watching the markets so you don’t have to”

(end)

(As mentioned please use the below disclaimer exactly) THANKS (Regulations)

This article expresses the opinion of Marc Cuniberti and is not meant as investment advice, or a recommendation to buy or sell any securities, nor represents the opinion of any bank, investment firm or RIA, nor this media outlet, its staff, members or underwriters. Mr. Cuniberti holds a B.A. in Economics with honors, 1979, and California Insurance License #0L34249. (530)559-1214. Marc was voted best financial advisor in the county 2021.